| Previous

Page |

PCLinuxOS

Magazine |

PCLinuxOS |

Article List |

Disclaimer |

Next Page |

Grisbi Revisited, Tips For Beginners, Part One |

|

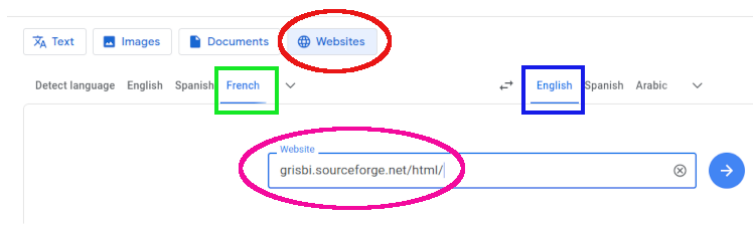

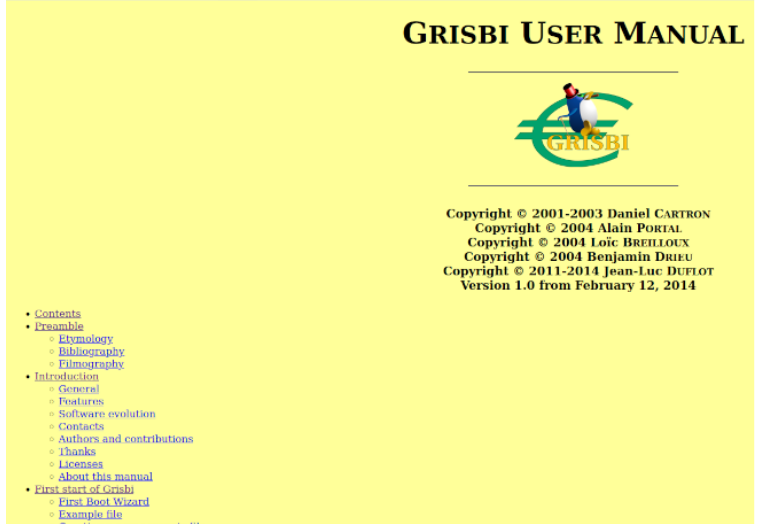

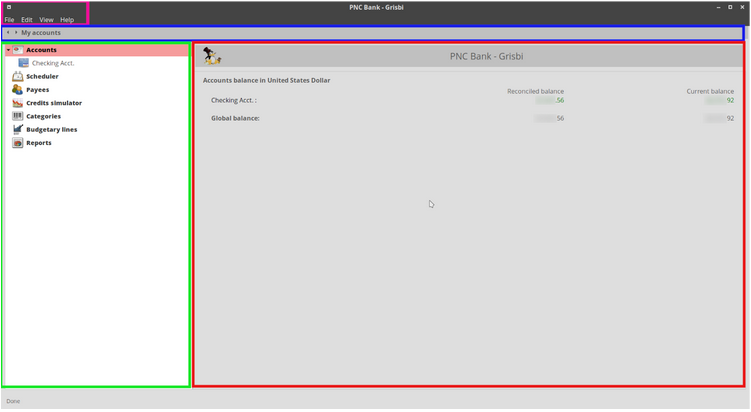

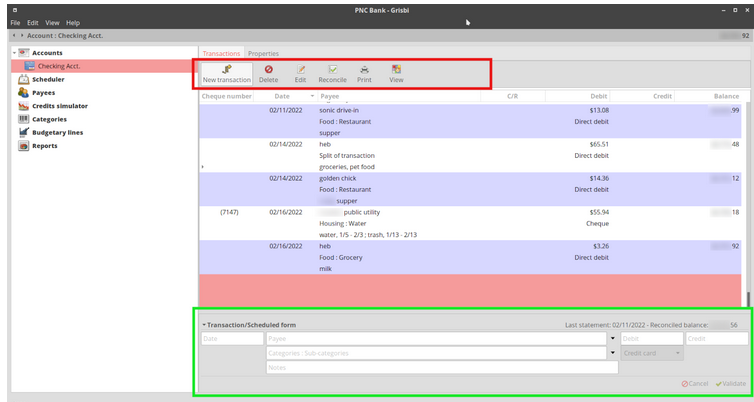

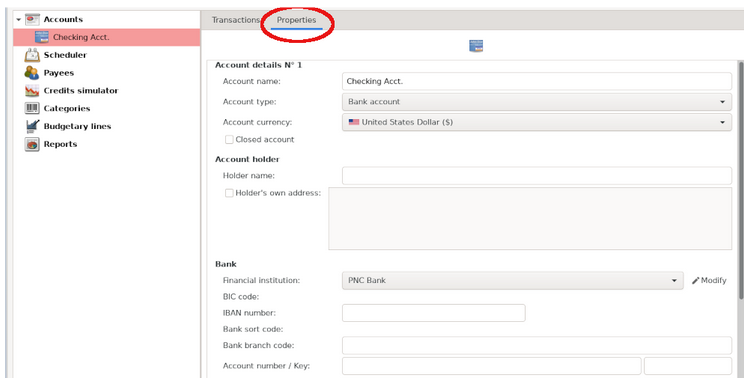

by David Pardue (kalwisti) In my pre-Linux computing life, I was a Mac person. At home, we had a Macintosh LC (with its iconic "pizza box" case) which my father generously handed down to us. Besides word processing, the Mac's secondary use was bookkeeping; it came with a copy of Quicken that kept track of our checking account for several years. Quicken and its early-1990s-style interface was my first exposure to personal finance software. I continued with Quicken until 2007, when I bought a refurbished PC from Goodwill to experiment with Linux. While searching for FOSS alternatives to Quicken, I found mentions of GnuCash, HomeBank and Grisbi. I tried them all. My goal was to run GnuCash but at the time its learning curve was too steep for me; I ended up using Grisbi (probably ver. 0.5.9). Grisbi served me well and my impression was that its interface was the most "Quicken-like" of the three programs. (While researching this article, I read some French-language comments that users believe Grisbi is also the closest equivalent to the discontinued Microsoft Money 1991-2009.) After some time and effort, I figured out how to use GnuCash and moved away from Grisbi.  I decided to reacquaint myself with Grisbi, since I have fond memories of the app. Grisbi is one of the oldest FOSS personal finance programs; it was first released in April 2000. (GnuCash's first stable release was in 1998 -- as was HomeBank's.) It is GTK-based and cross-platform, with versions available for Linux, Windows and macOS. Grisbi is not flashy but is designed to be easy and efficient. The user interface is fairly intuitive; it feels more like navigating through an email program than accounting software. Grisbi was created by a team of French developers, so it is fully compliant with French accounting principles. Grisbi's stated philosophy is to provide novice users with easy-to-use software that requires little or no reading of the program's documentation, while allowing advanced users to accomplish more by familiarizing themselves with the manual. Although it is presented as "personal accounting", it is also suitable for small and medium-sized nonprofit organizations. The current stable version of Grisbi is 2.0.5. (For the adventurous, there is also an unstable/testing branch, 2.9.90, released for Windows and macOS.) The two main developers are Pierre Biava (since 2008, working on GNU/Linux) and Ludovic Rousseau (working on macOS). Dr. Rousseau has been employed in the smart card industry for more than twenty years; he has contributed smart card-related packages to Debian since 2001. This finance program has had two unusual names. It was originally called Gripsou, but was renamed by the developers to avoid potential trademark infringement. Gripsou is the name of Disney cartoon character Archibald Gripsou, the French equivalent of Flintheart Glomgold. For non-comics readers like me, Flintheart Glomgold is the business rival and archenemy of Scrooge McDuck, usually portrayed as selfish, sneaky and greedy -- with the goal of becoming the world's richest duck. Grisbi (pronounced "greez-bee") is argot for 'loot', 'dough', 'money'. The term is most prominently known for its use in Albert Simonin's crime novel, Touchez pas au grisbi! [Don't Touch the Loot (1953)], which was turned into a famous film starring Jean Gabin, Lino Ventura and Jeanne Moreau. Grisbi uses single-entry accounting (like HomeBank or Quicken) rather than double-entry principles (GnuCash or KMyMoney). As a historical aside, a brief sketch of Luca Pacioli (1445-1517), the “inventor” of double-entry accounting, was featured on NPR's Planet Money podcast. The hosts interviewed Jane Gleeson-White, who wrote a biography of Pacioli. However, Grisbi is robust and perfectly adequate for home/personal accounting. I have been using Grisbi for the past twenty-three months, and the program has been as stable as a rock. A complete tutorial is beyond the scope of this article. Today, I will limit myself to discussing some features which average users will likely need in the course of their routine data entry. User Manual One previous drawback of Grisbi is that its documentation is mostly in French. While running the program, if you press the F1 function key to open the User's Manual in HTML, an incomplete -- and outdated (2003) -- page displays in English. If you can read French, you will discover that the user manual is very thorough; it explains concepts, procedures, configuration settings, etc. The manual was produced with LaTeX and includes an index and glossary, as well as hypertext links. There are two PDF versions of the manual: an illustrated version; and a text-only version. The original French user manuals are here. The French-language HTML version of the manual is available here. However, even if you do not know French, there are several workarounds. One possibility is to use Google Translate to translate the French website into English:   In case you prefer a PDF version, I used Google Translate's ability to produce a PDF English translation of the user manual. You can download the files from my PCLOS Cloud account. You can download the illustrated version [259 p., 14 MB], or you can download the text-only version [213 p., 7MB]. If you have a reading knowledge of German, there is an unofficial German version of the user guide (Grisbi Benutzerhandbuch [68 p., 429 kB]), translated by Martin Stromberger in 2018. He also wrote a quick-start guide (Grisbi Schnelleinstieg [5 p., 60 kB]). Both manuals are available here. User Interface When the application starts, Grisbi displays its home page. I have color-coded the UI's main components. The standard Menu Bar is outlined in magenta; the Information Bar is outlined in blue. The Navigation Panel is indicated by a green rectangle and the Details Box is outlined in red.  In the Navigation Panel, clicking on your account name (under Accounts) will open a traditional Account Ledger (which the Grisbi manual refers to as "Account Transactions"). With the Transactions tab forward, you will see a toolbar (outlined in red) with icons to perform various operations. At the bottom of the window is the Transaction Entry Form (outlined in green).  The Properties tab shows details about the active account, such as the account name, type of account, currency, name of the financial institution and the initial balance.  Types of Accounts Grisbi can manage four different types of accounts:

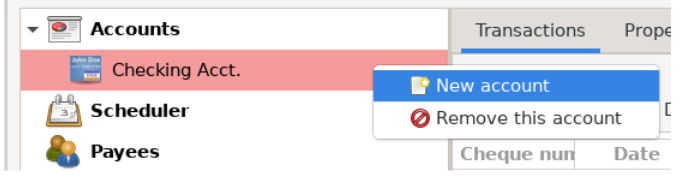

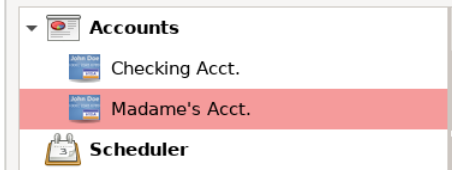

For family accounting situations, you will normally have only one account file [viz., My accounts.gsb], as this allows exchanges/transfers between your different accounts. For instance, in Grisbi's sample file, under the primary account, there is an account for the husband ('Compte Monsieur') and for the wife ('Compte Madame'). Grisbi's developers provide two sample files: one that demonstrates 'personal' use (Example_1.0.gsb); one with examples of 'organizational' use (Association_1.0.gsb). Although the entries are in French, you might find the examples helpful. You can download them from here. If you manage an association (such as a nonprofit organization), or another person with no accounting relationship to you, you should create another account file [e.g., My Local LUG.gsb]. I do not normally set up a "family" account hierarchy, so it required some experimentation to create this arrangement. If you would like this sort of hierarchy, follow these steps: First, open your primary account within Grisbi. Second, right-click on the account's name and choose the option "New account". Alternatively, from the Edit menu, select the option New account.  This will start an assistant/wizard that will guide you through the necessary steps to create the new account. When that process finishes, you should see something like this:  After creating Madame's Acct., I entered some test transactions and successfully transferred funds between it and the Checking Acct., and vice versa. Next month, we’ll take a look at getting started with Grisbi, setting up accounts, reconciling accounts, and actually using Grisbi. |